Reshoring of manufacturing to the United States has been happening, is happening, and can be expected to accelerate as a result of proposed policies from the Presidential administration. Here’s a rundown of how to better understand which sectors are reshoring, what types of jobs are reshoring, and how companies can best position themselves to reap the rewards.

Key findings are…

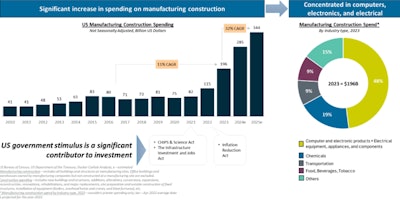

- U.S. construction spending on manufacturing facilities is forecasted to grow 32% annually going forward; nearly half of this spending (48%) will be on facilities producing computer and electronic products, electrical equipment, appliances, and components.

- Reshored Foreign Direct Investment (FDI) jobs have increased from ~100k-150k per year before the pandemic, to ~400k per year post-pandemic.

- Key drivers of reshoring include U.S. government policies, geopolitical risks, and declining total manufacturing cost differences between the Untied States and typical offshoring locations (especially China).

- The re-election of Donald Trump will further accelerate this trend due to increased geopolitical uncertainty and increased costs to offshoring (tariffs).

- Lack of skilled manufacturing labor in the United States is main barrier to increased reshoring.

1 - Where is reshoring happening, and what are implications for delivering construction projects?

As seen in Figure 1, there is ongoing and forecasted immense growth in manufacturing construction spending in the United States.

The greatest risk and largest barrier to a rebirth of U.S. manufacturing is the dearth of skilled manufacturing labor. CEOs report this as their main concern in a recent survey; see Figure 2.

As such, companies are investing in automation to mitigate the dearth of properly skilled labor to deliver on the promise of reshoring. See Figure 3.

Simply put, for those delivering and/or serving construction projects…

- Reshoring is happening and accelerating

- New manufacturing facility construction as a result of reshoring is concentrated in computers, electronics, electrical equipment, and related components

- Automation solutions in construction, both exterior building envelope and interior building systems will be required to deliver

2 - As a manufacturer serving construction projects, how can you capitalize?

If your company is considering how to revise its supply chain approach and capitalize on manufacturing opportunities resulting from accelerating reshoring, there are four keys on which to focus to develop a winning reshoring strategy:

- Establish a fit-for-purpose total cost calculator

- Invest in talent and automation synergies

- Place a premium on quality

- Be proactive in customer targeting

Total Cost Calculator

While it may seem obvious that you must calculate total costs when evaluating reshoring decisions, many companies still focus simply on direct costs, the costs/price of sourced components, tariffs/taxes/fees, and shipping. Procurement is traditionally measured and compensated based on these direct costs, which leaves out the indirect, perhaps hidden costs of production and sourcing from certain global regions or countries. These indirect, hidden costs can include several of the following:

· Risk and volatility of costs of producing and sourcing in certain countries, including the potential volatility of international trade policies (tariffs, retaliatory tariffs, sanctions, etc.)

· Potential for supply chain disruptions leading to the inability to produce or source certain components or items, leading to delayed final production and therefore delayed or lost sales to a competitor

· Additional labor costs and other ancillary costs of managing disruptions and dealing with exceptions to standard, efficient production, sourcing, and supply chain processes

· Quality risk of production and sourcing in certain countries, which can lead to disappointed customers, elevated warranty and/or recall costs, brand erosion, and lost sales

As you build your total cost calculator, ensure you think expansively and evaluate the hidden, indirect costs and risks of production and sourcing decisions specific to your company and the markets it serves. Artificial intelligence (AI) tools can assist in developing a robust total cost calculator, scraping tariff and other fees from all countries and updating as these change, seemingly on a daily basis.

Talent and automation synergies

A challenge to reshoring to the United States for any company is the dearth of properly skilled labor to operate production facilities. Operating factories today requires more technical, analytical, and digital skills than in the past. To mitigate the dearth of properly skilled labor, and for general efficiency and cost reasons, investments in factory automation will be required. Increased factory automation will further change the nature of the skills required to operate production facilities, elevating the analytical skills required to oversee and manage robots and other automation solutions. This will also include programming skills and the ability to evaluate and use the data and information being captured and produced by automation solutions. This means your company will need to enhance training for a different role than traditionally existed – a skill level below an engineer, but above the typical line worker, who may emerge from trade schools or other technical education and need to be extensively trained on your automation solutions and production approaches. Further, automation solutions will need to be designed with worker experience and usability in mind such that this new type of worker can be quickly upskilled and trained to operate.

Quality

With the opportunity to build new, modern, state-of-the-art production facilities in the United States, your company now can re-evaluate all processes to drive higher quality outputs. The benefits of higher quality can more than offset the potential higher costs of production and sourcing in the United States. These benefits can include increased sales, market share gains against competitors, enhanced brand reputation, and lower warranty and/or recall costs. This is a unique opportunity to go beyond optimizing your supply chain, to reimagining what is possible in terms of production and sourcing processes to change the game against your competitors.

Proactive customer targeting

Often, the opportunity to capitalize on reshoring decisions results from a bad experience where a customer decides to re-evaluate its suppliers, creating an opening for your company to pounce. Given this, you must stay on top of industry issues and risks, communicate consistently with potential customers, and be ready to pounce when the opportunity presents itself. As you build enhanced production and sourcing capabilities to take advantage of this changing global environment, determine your target customers and stay close to them to win more business as the opportunity arises. Ensure you can demonstrate your new, enhanced processes and the benefits they will bring for customers reeling from global supply chain challenges.

Disruption presents opportunity, if you are bold enough to go after it. The volatile geopolitical environment, perhaps forcing reshoring decisions, presents the opportunity for your company to change the game. Ensure you have a robust, fit-for-purpose total cost calculator, invest in talent and automation synergies, put a premium on enhanced quality, and proactively target the right customers to win more business.

![Lee Boy Facility 2025 17 Use[16]](https://p1-cms-assets.imgix.net/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)